IVA Information

An IVA (Individual Voluntary Arrangement) is a solution available to you if you have debts above £8,000 and can no longer afford the repayments. It is a formal solution, sometimes referred to as an alternative to bankruptcy. You must be a resident in England, Wales or Northern Ireland in order to do an IVA.

What happens in an IVA?

In an IVA, you agree to pay reduced affordable monthly payments that go towards your debts. The monthly payments usually last for 60 months and at the end of the IVA, any remaining debts owed are completely written off.

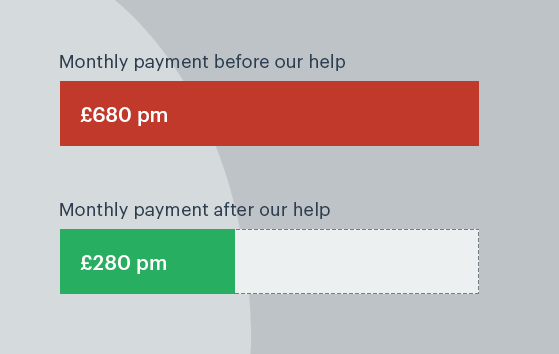

See the example below to understand more about how an IVA works.

Get IVA Advice

Fill in the form and we will get back to you

IVA ni Example - client with £26,850 Debt

Our client was struggling to pay the required amount of £680 each month on credit card and loan debts. They contacted us at IVA Northern Ireland to see if there was anything we could do to help. After analysis of their situation we were able to get their monthly repayment reduced to £280 per month, which was a realistic and affordable monthly payment for them. They will be paying this for 60 months.

At the end of the IVA they will be completely free of their debt, having repaid £16,800 and having written off £10,050.

How do I set up an IVA?

We work out what you can realistically afford to pay to your creditors, by assessing your current financial situation. Once we know what you can afford to pay, we will draft your IVA proposal which will be sent to your creditors to vote on.

We work out what you can realistically afford to pay to your creditors, by assessing your current financial situation. Once we know what you can afford to pay, we will draft your IVA proposal which will be sent to your creditors to vote on.

If 75% of your creditors (by debt vlaue) agree to the IVA proposal, then we can put your IVA in place and you can begin with your new repayment plan. We can have your IVA up and running in as little as 4 weeks.

PLEASE NOTE: By law, an Insolvency Practitioner (IP) is needed to set up and negotiate your IVA. It is not something you can do yourself.

If an IVA is not the best option for you or if your IVA proposal is not accepted, we can discuss what other options are availabe for you.

How much will I pay?

Every IVA is different. Your monthly payment is worked out according to your circumstances. Your employment status, income and expenditure, the amount of unsecured debts and number of creditors you have are all considered.

Advantages of an IVA

- 1 affordable monthly payment based on your income and expenses

- We do not charge any Upfront Fees, saving you £100s

- An IVA offers you protection from creditors

- Creditor pressure stopped as creditors must deal with us

- Can be complete in as little as 1 year if you can offer a lump sum payment

- All interest frozen immediately

- Suitable for tenants, homeowners, individuals, couples and self employed

- We can setup an IVA in as little as 4 weeks

Disadvantages of an IVA

- If you are a homeowner with equity in your property you may be required to remortgage and introduce part of your equity into the IVA. If you can’t get a remortgage your IVA arrangement could be extended for a period of time.

- If your circumstances change financially, and your IP can’t get creditors to accept amended terms, your IVA could fail. You will still owe your creditors the debt amount, minus what has been paid already in your IVA.

- If your IVA fails, your creditors may request that you be made bankrupt.

- Your credit rating may be impacted for up to six years from the start of your IVA.

NOTE: In an IVA you will have an agreed budget for your living costs. These expenses will be mostly based on what you currently have to pay out each month. You should declare all normal monthly expenses to your creditors so they understand your situation more clearly.

Can I apply for an IVA?

You can apply for an IVA if…

- You have debts over £8,000

- You have 2 or more creditors (people you owe money to).

- You have a surplus income each month (after all your essential living expenses), excluding debt payments

- You are struggling with your Debts

making my IVA Application

To apply for an IVA we need you to provide us information on the following things

- A full list of all of your creditors you owe money too and the current debt levels. Including all store cards, loans, HP agreements, catalogue debts, unpaid utility bills etc.

- Any assets that you own including your house, cars, policies etc.

- A breakdown of your monthly household bills and income and expenditure.

You can fill out all of the above information on our debt calculator form and send it to us for review.

You do not need to contact your creditors to tell them that you are entering or applying for an IVA, we will take care of all creditor contact from the time you contact us. Once your IVA is agreed you will have no more contact from your creditors.

Contact us

Get in touch with Debt Advice NI and get help with your debts. Call us now on 0800 043 0550 or click here to visit our contact page.

Excellent company

Gave me help advice and confidence to deal with a very large and stressful financial situation that I could see no way out of. Many thanks. | Client review

Read more...