IVA Case examples

Below are some examples of how we have helped people with their debts.

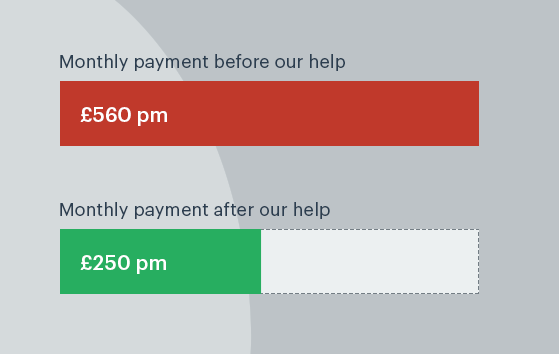

client with Debt Level of £19,000

Client was struggling to pay £560 per month on debts of £19,000. They were barely covering minimum repayments and couldn't even afford those. We were able to reduce payments down to a manageable £250 for 60 months.

After 60 months they became debt free. Any remaining debt was legally written off. They repaid £15,000 and wrote off £4,000.

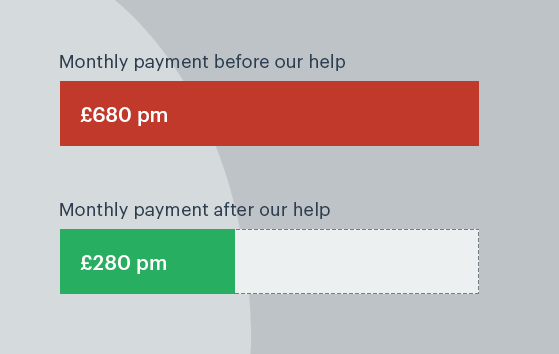

client with Debt Level of £26,850

Client with debts of £26,850 who couldn't afford the monthly payments of £680. We were able to get the payments reduced to £280 per month.

After 60 monthly payments they will be debt free with £16,800 of their debt paid off and £10,050 of their debt written off.

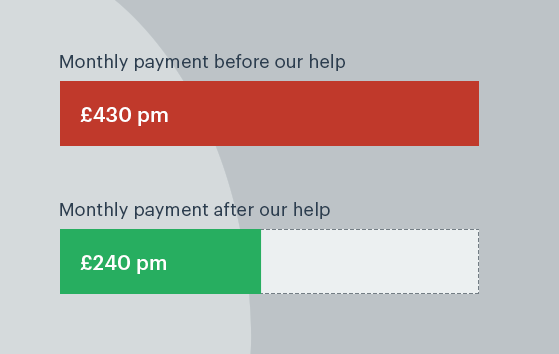

client with Debt Level of £18,300

Client was unable to meet the monthly payments of £430 per month on debts of £18,300. After analysing their situation we concluded that they could afford to pay £240 per month towards these debts. We negotiated this payment with their creditors.

They paid the agreed amount for 60 months and on completion, £14,400 of the debt was repaid with £3,900 written off.

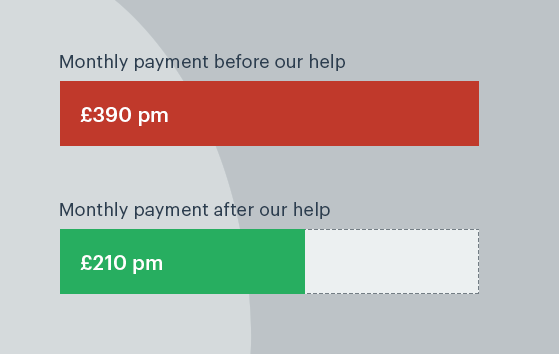

client with Debt Level of £15,990

Client was struggling to pay £390 per month on debts of £15,990. We got the monthly payments down to £210 for 60 months. All interest and charges were completely frozen.

After 60 months they will become debt free, repaying £12,600 and wrtiing off £3,390.

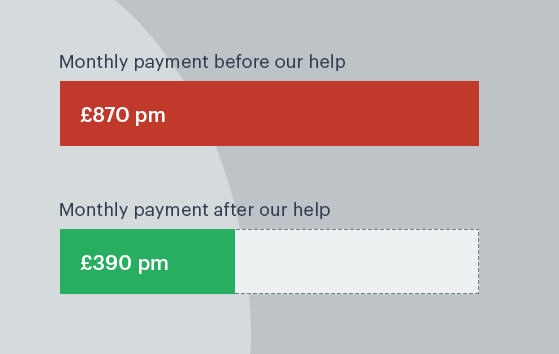

client with Debt Level of £46,060

Client was struggling to pay £870 per month on debts of £46,060. We were able to reduce payments down to £390 per month for 60 months.

After 60 months they became debt free. Any remaining debt was legally written off. They repaid £23,400 and wrote off £22,660.

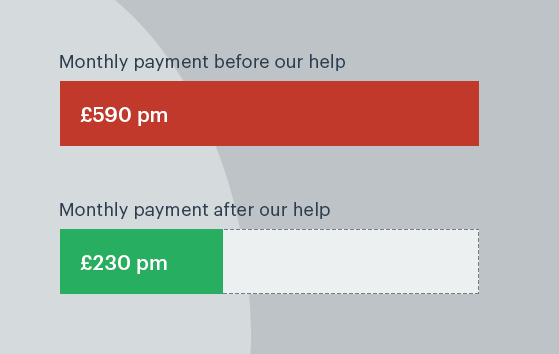

client with Debt Level of £17,540

Client was unable to pay the £590 per month on debts of £17,540. We managed to get the payments reduced to £230 per month for a period of 60 months.

After 60 months they became debt free. Any remaining debt was legally written off. They repaid £13,800 and wrote off £3,740.

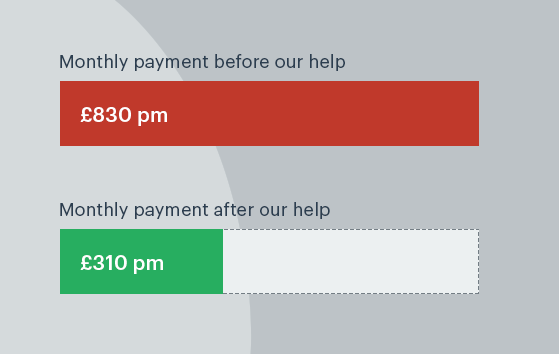

client with Debt Level of £37,320

Client with debts of £37,320 in total, was struggling to pay £830 per month. We were able to reduce payments down to £310 per month for 60 months.

After 60 months they became debt free. Any remaining debt was legally written off. They repaid £18,600 and wrote off £18,720.

Get Debt Advice

Fill in the form and we will get back to you

Excellent company

Gave me help advice and confidence to deal with a very large and stressful financial situation that I could see no way out of. Many thanks. | Client review

Read more...